Energy and Power

Critical Minerals Market

Critical Minerals Market Size, Share, Growth & Industry Analysis, By Mineral Type (Copper, Lithium, Nickel, Cobalt, Rare Earth Elements), By Application (Agriculture, Electric Vehicles, High-Tech Electronics, Telecommunications, Energy, Others) and Regional Analysis, 2023 - 2030

Pages : 120

Base Year : 2022

Release : November 2023

Report ID: KR356

Critical Minerals Market Size

The global Critical Minerals Market size was valued at USD 320.43 billion in 2022 and is projected to reach USD 494.23 billion by 2030, growing at a CAGR of 5.69% from 2023 to 2030. In the scope of work, the report includes products offered by companies such as Rio Tinto, Vale, Glencore, Freeport-McMoRan, Anglo American plc, Albemarle Corporation, Lynas Rare Earths Ltd, Barrick Gold Corporation, BHP, SQM S.A. and Others.

The rapid adoption of clean energy technologies such as solar PV and batteries is driving the demand for critical minerals, creating significant growth opportunities in the market. As the demand for these technologies continues to rise, it becomes imperative for businesses in the critical minerals industry to prioritize sustainable and responsible practices. Adopting responsible practices ensures the well-being and safety of workers, local communities, and indigenous populations. This includes fair labor practices, respecting human rights, and engaging in transparent and ethical business operations. By implementing sustainable practices, businesses can minimize their impact on the environment, including reducing energy consumption, minimizing waste generation, and protecting ecosystems.

Analyst’s Review

The trend can be attributed to the increasing demand for minerals essential for producing clean energy technologies. These technologies, including solar PV and batteries, rely on critical minerals such as lithium, cobalt, nickel, and rare earth elements. These minerals are crucial for the manufacturing of solar panels, lithium-ion batteries, and other components used in renewable energy systems. The deployment of solar PV systems has significantly contributed to market growth. Solar PV technology harnesses sunlight to generate electricity, requiring materials such as silicon, silver, and indium. The increasing adoption of solar PV systems worldwide has created a substantial demand for these minerals.

Market Definition

Critical minerals are a group of essential elements that are vital for the development and advancement of modern technologies. These minerals have gained significant attention due to their economic and strategic importance. They are used in various industries, including renewable energy, electronics, defense, and manufacturing. The scarcity and limited supply chains of these minerals make them critical to ensure a sustainable and secure future.

Lithium, a type of critical mineral, is used in the production of lithium-ion batteries, a key component in electric vehicles and energy storage systems. The demand for lithium has surged with the increasing popularity of electric vehicles and the need for renewable energy storage. Another critical mineral is cobalt, which is crucial for the production of rechargeable batteries. Cobalt holds significant importance, especially in the context of the transition to clean energy, as it is used extensively in the production of electric vehicle batteries.

Rare earth elements (REEs) are also critical minerals that have gained attention due to their importance in various high-tech applications. REEs are used in magnets, electronics, and defense systems. They play a vital role in the production of smartphones, wind turbines, electric vehicles, and other advanced technologies. The reliance on a limited number of countries for rare earth elements has raised concerns about supply chain vulnerabilities and geopolitical risks.

To mitigate these concerns, countries are implementing strategies to secure their critical mineral supply chains. This includes diversifying sources of critical minerals, promoting domestic production, and exploring recycling and reusing options. International cooperation is also being fostered to ensure a reliable and sustainable supply of critical minerals. The focus is on reducing dependence on a single country or region and building resilient supply chains to support economic growth and national security.

Critical Minerals Market Dynamics

The increasing demand for electric vehicles (EVs) has significantly fueled the use of critical minerals. EVs rely heavily on rechargeable batteries, which require specific minerals for their production. As the adoption of EVs continues to rise, the demand for these critical minerals is expected to increase substantially. One of the critical minerals in high demand for EVs is lithium. Lithium-ion batteries are widely used in EVs due to their high energy density and long lifespan. The surge in EV sales has led to a considerable rise in the demand for lithium, a key component of these batteries. This increased demand has put pressure on the global supply of lithium, leading to concerns about potential shortages and the need for diversification of supply sources.

Price volatility is a significant concern in the critical minerals market. Factors such as demand-supply imbalances, geopolitical tensions, market speculation, and economic conditions can contribute to price fluctuations. The clean energy sector, which heavily relies on critical minerals, is particularly vulnerable to these price swings. Addressing price volatility requires diversifying supply sources, promoting responsible sourcing practices, investing in alternative technologies, and fostering international cooperation. These measures can help ensure a stable and sustainable supply of critical minerals, mitigating the risks associated with price volatility and supporting the transition to clean energy.

Segmentation Analysis

The global market is segmented based on mineral type, application, and geography.

By Mineral Type

Based on mineral type, the critical minerals market is categorized into copper, lithium, nickel, cobalt, and rare earth elements. The copper segment held the largest market share of 51.06% in 2022 owing to the increasing usage of copper-based applications. Copper is a vital component used in various industries, including clean energy technologies, electrical systems, and infrastructure development. As the world transitions to cleaner energy sources and electrification, the demand for copper is expected to rise.

By Application

Based on application, the critical minerals market is divided into agriculture, electric vehicles, high-tech electronics, telecommunications, energy, and others. The electric vehicles segment accumulated the largest market share of 30.50% in 2022. The industry that mostly uses critical minerals is the clean energy sector. Critical minerals, such as lithium, cobalt, nickel, and rare earth elements, are crucial for the production of clean energy technologies such as batteries for electric vehicles and renewable energy storage systems. These minerals are also used in other clean energy applications, including wind turbines and solar panels. The clean energy sector heavily relies on these critical minerals to support the transition to a more sustainable and low-carbon future.

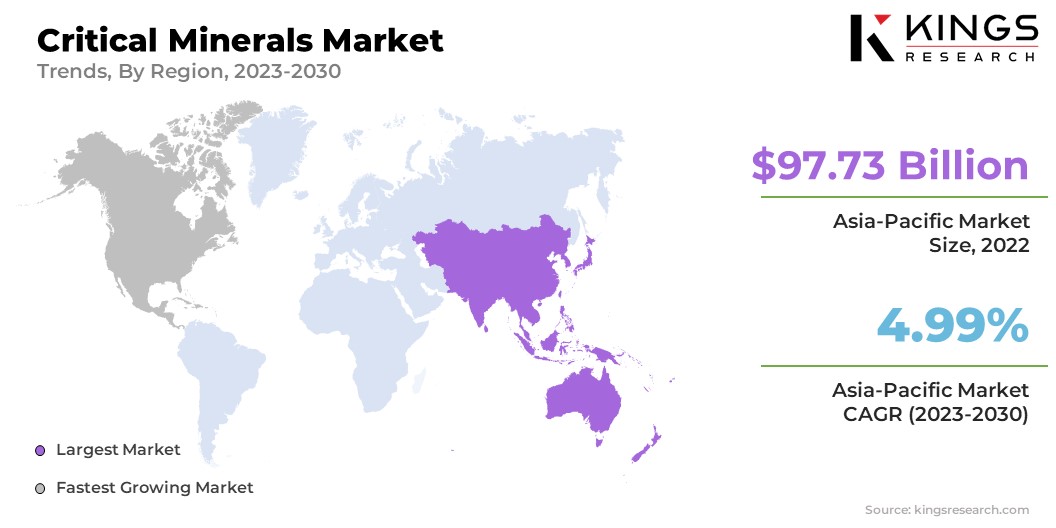

Critical Minerals Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

The Asia-Pacific Critical Minerals Market share stood around 30.5% in 2022 in the global market, with a valuation of USD 97.73 billion. Primarily driven by its significance in semiconductor manufacturing and decarbonization efforts, which highlights its importance in securing access to these essential resources. Strengthening regional supply chain resiliency and coordinating critical mineral development in the region are key considerations for various stakeholders. The region's diverse supply chains and its role as both a major supplier and consumer of critical raw materials make it a focal point for discussions on sustainable development and trade facilitation.

China holds a leading position in the global critical minerals market. China's strategic position in mineral processing and its low costs have contributed to its dominance in the market. In 2022, its domestic production reached 210,000 metric tons. At present, China's rare earth industry is managed by six state-owned mining companies, which theoretically enables China to maintain a firm grip on production. However, India is also a major contributor to the growth of the market. For instance, in July 2022, Australia and India entered into a strategic partnership to enhance collaboration in the development of critical minerals projects and supply chains.

Competitive Landscape

The global critical minerals industry report will provide valuable insight with an emphasis on the consolidated nature of the global market. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Expansion & investments are the major strategic initiatives adopted by companies in this sector. Industry players are investing extensively in R&D activities, building new manufacturing facilities, and supply chain optimization.

List of Key Companies in Critical Minerals Market

- Rio Tinto

- Vale

- Glencore

- Freeport-McMoRan

- Anglo American plc

- Albemarle Corporation

- Lynas Rare Earths Ltd

- Barrick Gold Corporation

- BHP

- SQM S.A.

Key Industry Developments

- September 2023 (Funding): Albemarle Corporation announced that the U.S. Department of Defense had granted $90 million to facilitate the growth of domestic mining and lithium production. This funding aimed to bolster the nation's battery supply chain, ensuring a secure and sustainable source of lithium for various industries.

- July 2023 (Partnership): Vale signed a binding agreement with Manara Minerals, a JV between Ma'aden and Saudi Arabia's Public Investment Fund, for a $26 billion investment in Vale Base Metals Limited (VBM). Concurrently, Vale also reached a binding agreement with Engine No. 1 for an investment in VBM under the same terms.

- April 2023 (Agreement): Rio Tinto finalized a legally binding agreement to purchase the Platina Scandium Project from Platina Resources Limited for a total consideration of USD 14 million.

- November 2022 (Launch): BHP introduced a fully electric Jumbo at Olympic Dam, demonstrating the company's commitment to reducing operational greenhouse gas emissions. By minimizing reliance on diesel, this initiative aligned with BHP's target of reducing its environmental impact.

The global Critical Minerals Market is segmented as:

By Mineral Type

- Copper

- Lithium

- Nickel

- Cobalt

- Rare Earth Elements

By Application

- Agriculture

- Electric Vehicles

- High-Tech Electronics

- Telecommunications

- Energy

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)